McCloud Remedy

This page explains the McCloud judgment and changes to the Local Government Pension Scheme (LGPS) in England and Wales.

This page explains the McCloud judgment and changes to the Local Government Pension Scheme (LGPS) in England and Wales.

You do not need to contact us, please be assured we will contact anyone who is impacted by the change of regulations.

When the Government reformed public service pension schemes in 2014 and 2015, transitional protections were introduced for older members. In December 2018, the Court of Appeal ruled that younger members of the judicial and firefighters’ pension schemes had been unlawfully discriminated against because the protections did not apply to them.

This ruling is called the McCloud judgment, after a member of the Judicial Pension Scheme involved in the case. Because of the ruling, there will be changes to all public service pension schemes that provided transitional protection, including the LGPS.

The changes are called the McCloud remedy and are intended to remove the age discrimination found in the McCloud court case.

This change came into force on 1 October 2023 The Local Government Pension Scheme (Amendment) (No. 3) Regulations 2023. Underpin protection only applies to pension built up in the remedy period, between 1 April 2014 and 31 March 2022. The underpin will have stopped earlier if you left the scheme or reached your final salary normal retirement age (usually 65) before 31 March 2022.

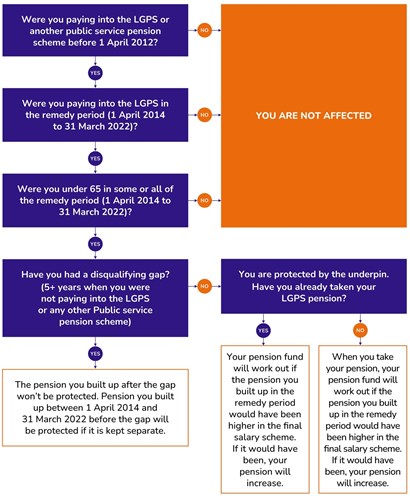

You can find out if you are affected using the flow chart below or going to the LGPS national member website and using their handy interactive tool at www.lgpsmember.org/mccloud-remedy/am-i-affected/

You do not need to take any action. The Fund will work out if you are due any additional pension (underpin). Not many members will see an increase in their pension because in most cases the pension built up in the Career Average Revalued Earnings (CARE) scheme, which came into effect on 1st April 2014 and applies to all members from this date, is higher than it would have been in the final salary scheme.

You do not need to contact us, please be assured we will contact anyone who is impacted by the change of regulations.

If you leave the pension fund, we will work out a provisional underpin amount, but the final underpin (additional pension) amount will be calculated when you take your pension benefits.

We have until August 2025 to include information about underpin protection for all qualifying members in the Annual Benefit Statement. If you take your pension benefits before this date, we will work out your entitlement to the underpin (additional pension) as part of your pension calculation.

You do not need to contact us, please be assured we will contact anyone who is impacted by the change of regulations.

If you are already receiving a pension, we will work out if you are due an addition to your existing pension. We will do this as soon as we can after 1 October 2023

Pensioners will be written to only if the ‘new underpin’ means that their pension increases.

You can find out more information about the McCloud Remedy using these resources.

The national LGPS member website for members in England & Wales. The McCloud Remedy explained with an overview of what the McCloud Remedy is, which members are affected, key dates and Frequently Asked Questions (FAQ).

The McCloud Remedy for the LGPS

This factsheet explains the McCloud judgment and changes to the Local Government Pension Scheme (LGPS) in England and Wales.

McCloud Judgement and your LGPS Pension

This factsheet explains the McCloud judgment and changes to the Local Government Pension Scheme (LGPS) in England and Wales.

LGPS Mccloud Factsheet 5P